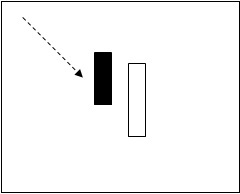

In order for the Piercing signal to be valid, the following conditions must exist:

·The stock must have been in a definite downtrend before this signal occurs. This can be visually seen on the chart.

·The second day of the signal should be a white candle opening below the low of the previous day and closing more than half way into the body of the previous day’s black candle

Example